carried interest tax uk

In fact the only other asset which is taxed at 28 is residential property. Historically carried interest returns have been taxed as capital gains arising on the disposal of a funds underlying investment a treatment preserved by the DIMF rules.

However carried interest is often treated as long-term capital gains for tax purposes subject to a top tax rate of 238 20 on net capital gains plus the 38 net investment income tax.

. Our previous blog article on the new rules for the taxation of carried interest looked at their general impact on investment managers including the introduction of the concept of income-based carried interest IBCI and the rule that carried interest that is not IBCI is to be treated as giving rise to UK situs capital gains irrespective of the situs of the underlying. Carried interest as a notional payment. Lawmakers estimated the provision would generate about 14 billion over 10 years compared with the.

PAYE and NICs indemnity. Some view this tax preference as an unfair market-distorting loophole. However the rate of CGT applicable to carried interest remains at 28 whereas a rate of 20 applies to most other types of capital gain.

Carried interest is received by a UK resident company. And that planning. Capital Gains Tax civil partners and spouses Self Assessment helpsheet HS281 Collection.

Capital gains tax treatment of carried interest. Current law on the taxation of carried interest within sections 103KA to 103KH Taxation of Chargeable Gains Act TCGA 1992 was introduced by section 43 of Finance No2 Act 2015 with effect for. Carried interest has increasingly come within HM Revenue Customs focus due to the potential risk of ordinary management fees being disguised as carried interest to avoid income tax.

This measure will make the tax system fairer by ensuring that individuals to whom a gain arises in the form of carried interest are taxed on their true economic gain. Carried interest will be partly IBCI if the. 8 Capital gains tax analysis.

Printable version Send by email PDF version. Withholding employee Class 1 NICs. Relief will only be available if the other tax paid is directly relatable to the carried interest amount received.

Some view this tax treatment as unfair because the general partner receives carried interest as compensation for its investment management services. Carried interest now falls into one of two categories. Carried interest on investments held longer than three years is subject to a long-term capital gains tax with a top rate of 20 compared with the 37 top rate on ordinary income.

Others argue that it is consistent with the tax treatment of other entrepreneurial income. Carried interest is wholly IBCI if the relevant fund holds its assets for an average of 3 years or less. We are aware of an increase in the number of enquiries into the tax treatment of carried interests HMRC are raising at a House level as well as at an individual level.

The carried interest loophole allows private equity barons to claim large parts of their compensation for services as investment gains. 16 hours agoA 2021 report by the financial-software company eFront found that the average length of a private-equity funds holding period in 2020 was already 54 years. Democrats agreed on a revised version of their tax and climate bill dropping a provision that would have narrowed a tax break for carried interest altering a 15 minimum tax on.

These enquiries are typically aimed at several investment management. 10 Capital gains tax analysis before 8 July 2015. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes.

From 6 April 2016 amounts of carried interest that arise from funds which do not hold their assets for 40 months or more can be classed as income based carried interest and will be charged to tax. If carry were treated as remuneration then it would be taxable as ordinary income at marginal federal rates ie. HMRC Enquiries into the Tax Treatment of Carried Interest.

The 1000 of interest is also carried interest and is also charged to CGT at 28 280 there is nothing in the measure to displace the Income Tax charge and so Income Tax at 45 450. The debate focused on the issue of whether carried interest should be taxed as an investment or as remuneration for services. We have agreed to remove the carried interest tax provision protect advanced manufacturing and boost our clean energy in the Senates budget reconciliation legislation Sinema said in a.

Under the IBCI Rules carried interest which is income-based carried interest will be taxed. Still the carried-interest tax provision was a relatively small part of the Inflation Reduction Act. 9 Reporting obligations in relation to carried interest.

Over 2015 and 2016 new rules relevant to carried interest were introduced that were designed both to reduce the scope for avoidance and to restrict the beneficial tax treatment. 21 hours agoLaura Davison. Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation.

The UK resident. Availability of business asset disposal relief and investors relief. Although it is true that carried interest gains are taxed at 28 this is a special higher rate than would be paid on other gains on share sales taxed at a maximum of 20.

Income Based Carried Interest IBCI which is subject to income tax and NIC and carried interest which is not IBCI which is subject to capital gains tax CGT.

What Is A Cd Certificate Of Deposit Napkin Finance Has The Answer

Carried Interest Plans Can Benefit Both The Fund Management Industry And Investors Intertrust Group

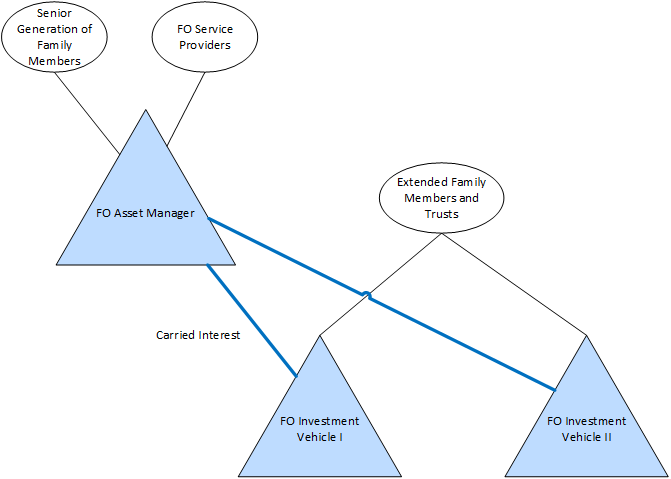

Carried Interest Deductibility Best Option For Family Office Structure

How Does Carried Interest Work Napkin Finance

Carried Interest In Venture Capital Angellist Venture

Pwc Cn Publication New Year Good News Carried Interest Tax Concession

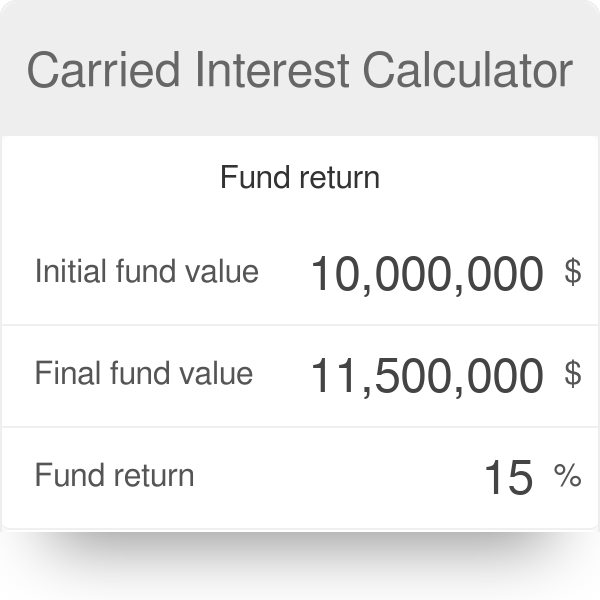

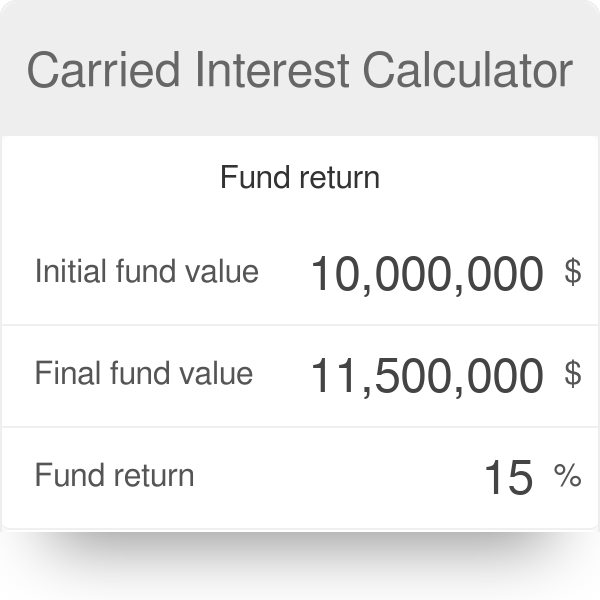

Carried Interest Calculator And Formula

How To Tax Capital Without Hurting Investment The Economist

Dezeen Book Of Interviews Now With Free Uk Shipping Book Design Dezeen Design

International Tax Attorney Matthew Ledvina Moves Into The Fintech Sector International Tax Attorney Matthew Ledvina Moves Into The Fintech Sector Tax Attorney Business Leader Matthews

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Learn The Tips For Reducing Inheritance Tax Liabilities At Http Www Harleystreetaccountants Co Uk Top Five Tips For Reducing Inheritance Tax Liabilities

220v 110v Nail Fan Acrylic Uv Gel Dryer Machine In 2022 Gel Uv Gel Dryer Machine

In 2011 Convey Sponsored A Tax And Regulatory Survey Carried Out By The Institute Of Financial Operations During A Time Of U Tax Infographic Accounts Payable

How Does Carried Interest Work Napkin Finance

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Are Teens Responsible With Their Money Family Budgeting

Taking Goods Temporarily Out Of The Uk How To Apply Understanding United Kingdom

Carried Interest In Private Equity Calculations Top Examples Accounting